Elgin Baylor Net Worth Income, a monetary figure reflecting the total value of an individual's assets minus their liabilities, is a common financial metric used to assess one's overall economic well-being. For example, if an individual owns a home valued at $500,000 and has no debt, their Elgin Baylor Net Worth Income would be $500,000.

Elgin Baylor Net Worth Income is an important measure of financial success and stability. It provides a snapshot of an individual's financial situation and can be used to track progress over time. This can be particularly useful for individuals who are planning for retirement or making major financial decisions.

Historically, Elgin Baylor Net Worth Income was calculated manually by subtracting liabilities from assets. However, with the advent of technology, there are now a number of online tools that can automate this process. This has made it easier than ever for individuals to track their Elgin Baylor Net Worth Income and make informed financial decisions.

Elgin Baylor Net Worth Income

Understanding the key aspects of Elgin Baylor Net Worth Income is crucial for making informed financial decisions. These aspects include:

- Assets

- Liabilities

- Cash flow

- Investments

- Savings

- Expenses

- Income

- Debt

By considering these aspects, individuals can develop a comprehensive understanding of their financial situation and make plans to improve their Elgin Baylor Net Worth Income. For example, an individual may choose to increase their income by getting a side hustle, reduce their expenses by cutting back on unnecessary spending, or invest their money in a diversified portfolio to grow their wealth over time.

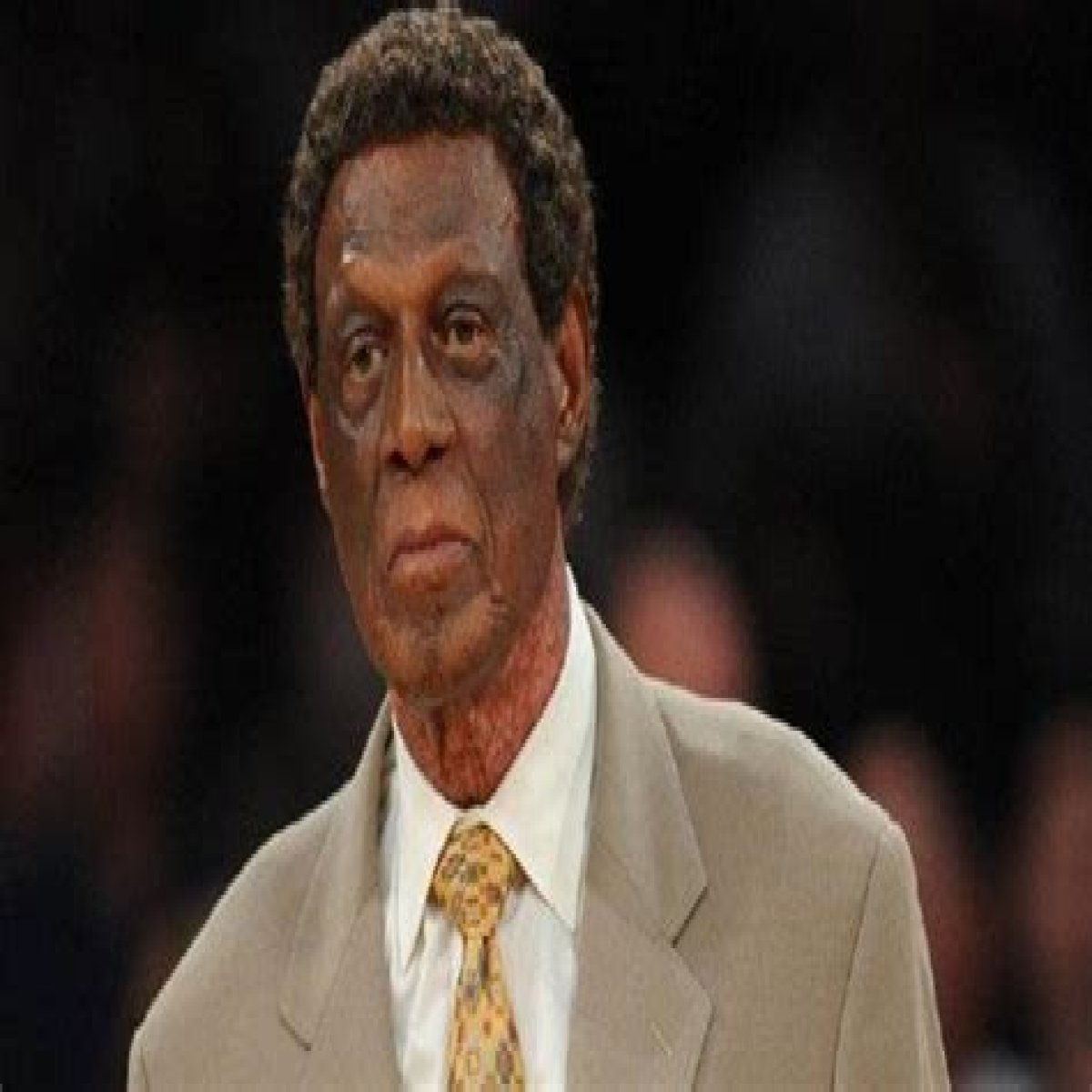

| Name | Born | Birth Place | Height | Weight | Position | Teams |

|---|---|---|---|---|---|---|

| Elgin Baylor | September 16, 1934 | Washington, D.C. | 6 ft 5 in (1.96 m) | 225 lb (102 kg) | Small forward | Los Angeles Lakers(19581971) |

Assets

In the context of Elgin Baylor Net Worth Income, assets refer to anything of value that an individual owns. This can include tangible assets, such as real estate, vehicles, and jewelry, as well as intangible assets, such as stocks, bonds, and intellectual property. Assets are a critical component of Elgin Baylor Net Worth Income because they represent the total value of an individual's wealth. The more assets an individual has, the higher their Elgin Baylor Net Worth Income will be.

There are many different ways to acquire assets. Some assets, such as real estate and vehicles, can be purchased outright. Other assets, such as stocks and bonds, can be acquired through investment. It is important to note that assets can also be liabilities if they lose value or become difficult to sell. For example, if an individual purchases a house that decreases in value, this would be considered a liability. Therefore, it is important to carefully consider the potential risks and rewards before acquiring any asset.

Understanding the relationship between assets and Elgin Baylor Net Worth Income is essential for making informed financial decisions. By increasing their assets and managing their liabilities, individuals can improve their Elgin Baylor Net Worth Income and achieve their financial goals.

Liabilities

In the context of Elgin Baylor Net Worth Income, liabilities refer to debts or obligations that an individual owes to others. This can include mortgages, auto loans, credit card debt, and personal loans. Liabilities are a critical component of Elgin Baylor Net Worth Income because they represent the amount of money that an individual owes. The more liabilities an individual has, the lower their Elgin Baylor Net Worth Income will be.

There are many different ways to acquire liabilities. Some liabilities, such as mortgages and auto loans, are used to finance the purchase of assets. Other liabilities, such as credit card debt and personal loans, can be used to cover unexpected expenses or to finance personal purchases. It is important to note that liabilities can also be assets if they are used to generate income. For example, a business loan that is used to purchase equipment that generates revenue would be considered an asset.

Understanding the relationship between liabilities and Elgin Baylor Net Worth Income is essential for making informed financial decisions. By managing their liabilities and increasing their assets, individuals can improve their Elgin Baylor Net Worth Income and achieve their financial goals.

Cash flow

Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business. It is a critical component of Elgin Baylor Net Worth Income because it represents the amount of money that a business has available to meet its financial obligations and invest in growth. A business with a positive cash flow is able to generate more cash than it spends, while a business with a negative cash flow is spending more cash than it generates.

There are many different factors that can affect a business's cash flow, including sales, expenses, and investments. For example, a business that experiences a sudden increase in sales may see its cash flow improve, while a business that makes a large investment in new equipment may see its cash flow decrease. It is important for businesses to carefully manage their cash flow to ensure that they have enough money to meet their obligations and continue operating.

There are a number of practical applications for understanding the relationship between cash flow and Elgin Baylor Net Worth Income. For example, businesses can use this understanding to make informed decisions about how to allocate their resources, invest in growth, and manage their debt. Individuals can also use this understanding to make informed decisions about how to manage their personal finances and invest for the future.

In summary, cash flow is a critical component of Elgin Baylor Net Worth Income. By understanding the relationship between cash flow and Elgin Baylor Net Worth Income, businesses and individuals can make informed decisions about how to manage their finances and achieve their financial goals.

Investments

Investments are a critical component of Elgin Baylor Net Worth Income. They represent the portion of an individual's or business's assets that are used to generate income or appreciate in value. By investing, individuals and businesses can grow their wealth over time and achieve their financial goals.

- Stocks

Stocks are a type of investment that represents ownership in a company. When you buy a stock, you are essentially buying a small piece of that company. Stocks can be a good investment because they have the potential to generate income in the form of dividends and capital gains.

- Bonds

Bonds are a type of investment that represents a loan to a company or government. When you buy a bond, you are lending money to the issuer of the bond. In return, the issuer agrees to pay you interest on the loan and repay the principal when the bond matures.

- Mutual Funds

Mutual funds are a type of investment that pools money from many investors and invests it in a diversified portfolio of stocks, bonds, or other assets. Mutual funds can be a good investment for those who want to diversify their portfolio and reduce their risk.

- Real Estate

Real estate is a type of investment that involves owning property, such as land, buildings, or homes. Real estate can be a good investment because it can generate income in the form of rent and it can appreciate in value over time.

Investments play a crucial role in growing wealth and achieving financial goals. By understanding the different types of investments available and how they can be used to generate income and appreciate in value, individuals and businesses can make informed investment decisions and improve their Elgin Baylor Net Worth Income.

Savings

Savings are a critical component of Elgin Baylor Net Worth Income. They represent the portion of an individual's income that is not spent on consumption and is instead set aside for future use. Savings can be used to achieve a variety of financial goals, such as buying a home, retiring, or starting a business. Individuals who save regularly are more likely to have a higher Elgin Baylor Net Worth Income than those who do not.

There are many different ways to save money. Some people choose to set up a savings account at a bank or credit union. Others choose to invest their savings in stocks, bonds, or mutual funds. Still others choose to save money by reducing their expenses or earning extra income. Regardless of how you choose to save, the important thing is to make saving a regular part of your financial plan.

There are many practical applications for understanding the relationship between savings and Elgin Baylor Net Worth Income. For example, individuals can use this understanding to make informed decisions about how to allocate their income, set financial goals, and plan for the future. By saving regularly, individuals can increase their Elgin Baylor Net Worth Income and achieve their financial goals.

Expenses

Expenses play a crucial role in Elgin Baylor Net Worth Income. They represent the portion of an individual's income that is spent on goods and services, and they can significantly impact an individual's overall financial well-being. Understanding the different types of expenses and how they can be managed is essential for maximizing Elgin Baylor Net Worth Income.

- Fixed expenses

Fixed expenses are those that remain relatively constant from month to month, such as rent or mortgage payments, car payments, and insurance premiums. These expenses are typically essential for maintaining a certain standard of living and can be difficult to reduce in the short term.

- Variable expenses

Variable expenses are those that fluctuate from month to month, such as groceries, entertainment, and dining out. These expenses are often more discretionary and can be more easily adjusted to fit an individual's budget.

- Discretionary expenses

Discretionary expenses are those that are not essential for survival, such as travel, hobbies, and luxury goods. These expenses can be reduced or eliminated to save money and increase Elgin Baylor Net Worth Income.

- Debt payments

Debt payments are a type of expense that can significantly impact Elgin Baylor Net Worth Income. High levels of debt can reduce an individual's cash flow and make it difficult to save for the future. Managing debt effectively is crucial for improving financial well-being.

By understanding the different types of expenses and how they can be managed, individuals can make informed decisions about how to allocate their income. Reducing unnecessary expenses, prioritizing essential expenses, and managing debt effectively can all contribute to increasing Elgin Baylor Net Worth Income and achieving financial goals.

Income

Income plays a pivotal role in Elgin Baylor Net Worth Income, representing the inflow of funds that contribute to an individual's overall financial well-being. Income can be derived from a variety of sources, each with its own unique characteristics and implications for Elgin Baylor Net Worth Income.

- Wages and salaries

Wages and salaries represent the compensation received for work performed as an employee. This is a common source of income for many individuals and can contribute significantly to Elgin Baylor Net Worth Income.

- Self-employment income

Self-employment income refers to earnings from individuals who work for themselves, such as freelancers, contractors, and business owners. This type of income can be more variable than wages and salaries and may require additional expenses for items such as health insurance and retirement savings.

- Investment income

Investment income is generated from investments, such as stocks, bonds, and real estate. This type of income can provide a passive stream of revenue and can contribute to long-term wealth accumulation.

- Other income

Other income includes earnings from sources such as government benefits, pensions, and annuities. This type of income can provide additional financial support and contribute to Elgin Baylor Net Worth Income.

Understanding the different sources of income and their implications is crucial for maximizing Elgin Baylor Net Worth Income. Individuals can explore various income-generating opportunities, diversify their income streams, and make informed financial decisions to enhance their overall financial well-being.

Debt

Debt plays a significant role in Elgin Baylor Net Worth Income, representing borrowed funds that must be repaid with interest. Understanding the connection between debt and Elgin Baylor Net Worth Income is crucial for informed financial decision-making.

Debt can impact Elgin Baylor Net Worth Income in several ways. High levels of debt can reduce an individual's cash flow, making it difficult to save and invest. Additionally, interest payments on debt can eat into an individual's income, further reducing their Elgin Baylor Net Worth Income. In extreme cases, excessive debt can lead to bankruptcy, which can have devastating consequences for an individual's financial well-being.

However, debt can also be a valuable tool for increasing Elgin Baylor Net Worth Income when used strategically. For example, taking on debt to finance a higher education or invest in a business can lead to increased earning potential and long-term wealth accumulation. It is important to carefully consider the risks and benefits of debt before taking on any new obligations.

In conclusion, debt is a multifaceted component of Elgin Baylor Net Worth Income that can have both positive and negative effects. By understanding the connection between debt and Elgin Baylor Net Worth Income, individuals can make informed financial decisions that maximize their overall financial well-being.

In conclusion, understanding "Elgin Baylor Net Worth Income" provides valuable insights into an individual's financial well-being and wealth accumulation. This article has explored key aspects of "Elgin Baylor Net Worth Income," including assets, liabilities, cash flow, investments, savings, expenses, income, and debt. These components are interconnected and play a crucial role in determining an individual's overall financial health.

Understanding the relationship between these elements empowers individuals to make informed financial decisions. By managing liabilities, increasing assets, and optimizing income and expenses, individuals can improve their "Elgin Baylor Net Worth Income" and achieve their financial goals. Furthermore, leveraging debt strategically for investments with high earning potential can contribute to long-term wealth accumulation. The insights gained from exploring "Elgin Baylor Net Worth Income" emphasize the importance of financial literacy and responsible money management for individuals seeking to enhance their financial well-being.

Dean Cain: A Heartwarming Reunion With His Parents And SonLoren Culp: A Political Journey And Personal Life UnveiledDiscover Luxury Living At The Bentley Westville Klaarwater South